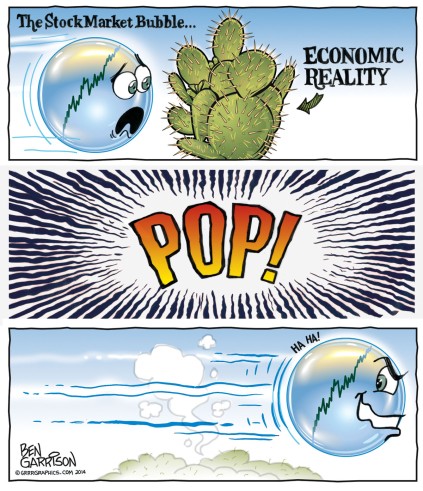

No stock picks today – I know, broken record. There are only two other times in history when stocks were more expensive than today, one led to the Great Depression, the other the dot-com bubble. We are already well past the excesses that led to the 2008 Great Recession.

Here are the valuation measures I track:

| Market Valuations: | Current | Mean | Delta |

| Shiller’s 10 Year PE Ratio: | 29.87 | 16.76 | 78.22% |

| Trailing 12 Month PE Ratio: | 25.79 | 15.66 | 64.69% |

| Tobin’s Q Ratio: | 1.07 | 0.68 | 57.35% |

| Market Cap to GDP: | 133.5 | 90.00 | 48.33% |

| Morningstar’s Fair Value: | 1.03 | 0.90 | 15.08% |

| Price to Sales: | 2.12 | 1.45 | 46.21% |

| Average Overvaluation: | 51.65% |

In this environment – it would be best to raise cash, and wait for something to break – but that is hard for most investors, and makes for a really boring blog (sorry).

The Federal Reserve might address valuations in their statement today – I will be looking for it, and update the blog accordingly.

- MarketWatch – Here’s what the Fed will signal when it hikes interest rates

- ZeroHedge – FOMC Delivers “Dovish Hike”, Lays Out Plans For Balance-Sheet Unwind

Something else to keep an eye on today – Oil is getting killed.

Extra – this is a depressing headline:

- Business Insider – Gun stocks jump after shooting at congressional baseball practice

Leave a Reply